In the evolving landscape of decentralized finance (DeFi), liquidity providers (LPs) must continually adapt to extract maximum

value from their capital while minimizing risks such as impermanent loss (IL) and losses due to delayed rebalancing (LVR). With Uniswap v3, concentrated liquidity has unlocked unprecedented capital efficiency—allowing LPs to focus their liquidity within narrow price ranges—but it has also introduced new challenges. At Steer Protocol, our integration with Allora Network’s AI-driven predictive price feeds is a game changer, enabling our Classic Rebalance and Fluid Liquidity strategies to proactively adjust positions and capture more fees in real time. This research deep dive explains the “why” and “how” behind our approach and its unique synergy with v3 liquidity dynamics.

The Dynamics of Uniswap v3 Concentrated Liquidity

Uniswap V3 revolutionized liquidity provision by allowing LPs to deposit liquidity within a specific price range rather than across the entire price spectrum. This concentrated liquidity model offers two key advantages:

- Capital Efficiency: By focusing liquidity where trading is most active, LPs earn significantly higher fee revenues per dollar of capital deployed.

- Optimized Fee Capture: When liquidity is tightly centered around the current price, the share of fees collected is maximized.

However, these benefits come with an inherent risk: if the market price moves outside the chosen range, an LP’s capital becomes inactive, resulting in missed fee opportunities and increased exposure to impermanent loss. In a rapidly shifting market, the narrow bands of v3 liquidity demand precision timing, as well as anticipatory repositioning, to maintain continuous in-range liquidity.

The Limitations of Reactive, Spot-Price-Based Strategies

Traditional LP strategies rely on spot-price triggers to rebalance positions. In a reactive model, the liquidity range is updated only after a significant price move has occurred. This lag creates several issues:

- Delayed Rebalancing: By the time the rebalancing action is taken, the market may have already moved further, exposing LPs to arbitrage and increasing LVR.

- Suboptimal Liquidity Deployment: Liquidity that is repositioned based solely on current prices may lag behind fast market moves, leaving capital stranded out-of-range.

- Heightened Impermanent Loss: When rebalancing occurs after significant price shifts, the asset ratios in the LP’s portfolio can deviate sharply from the optimal, deepening IL.

In the concentrated liquidity world of Uniswap v3, these challenges are amplified. The benefits of tight liquidity bands can quickly turn into vulnerabilities if the rebalancing is not executed proactively.

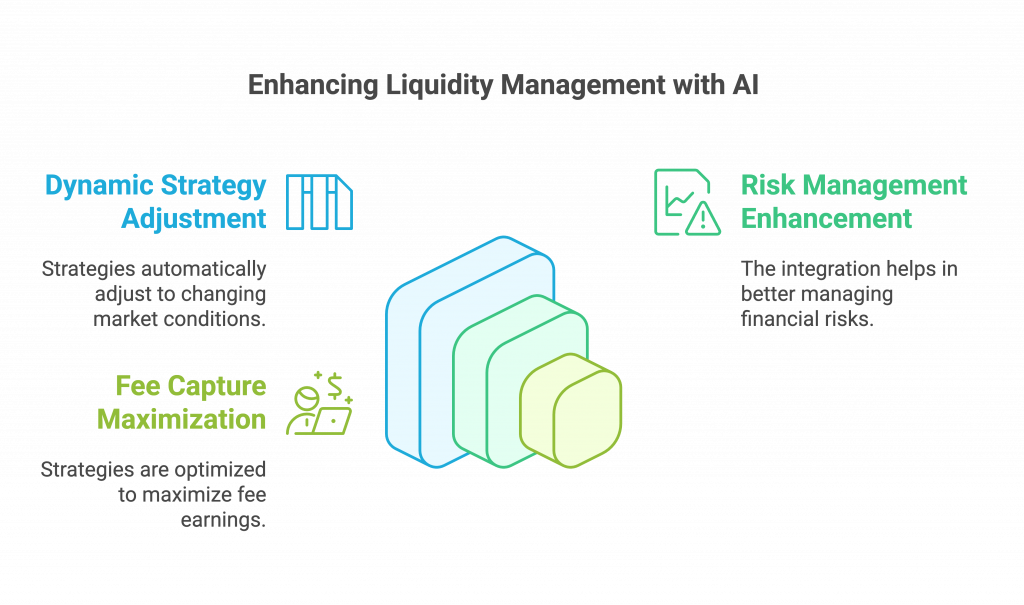

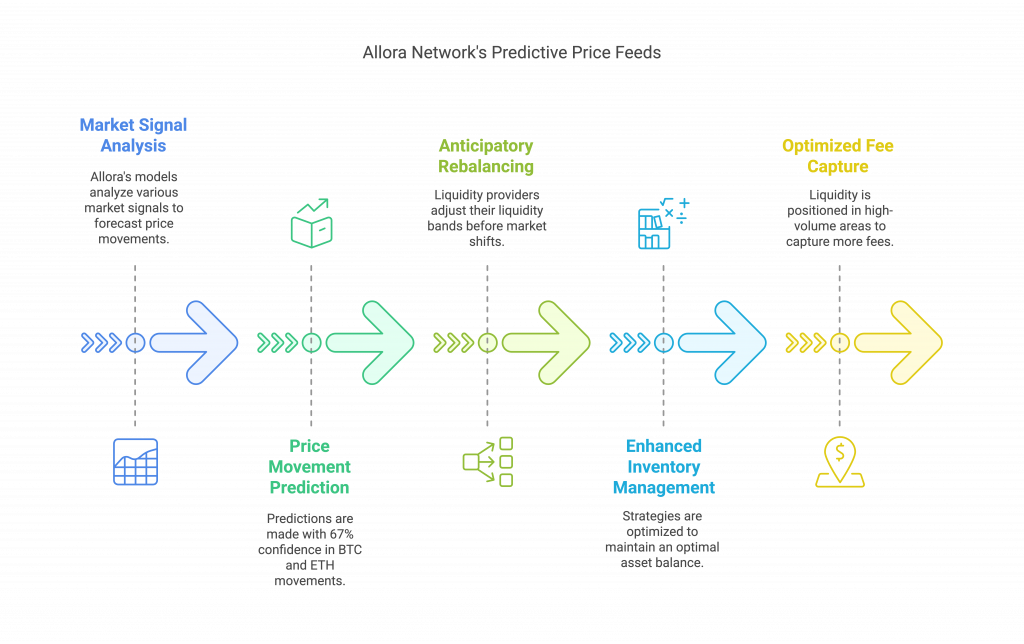

How Allora’s Predictive Price Feeds Make a Difference

Allora Network provides AI-powered price feeds that forecast near-term movements for assets like BTC and ETH with exceptional accuracy (95–99% in short-term horizons). These predictive signals empower LP strategies to anticipate market moves rather than merely react to them. Here’s why this matters for v3 liquidity:

- Preemptive Positioning: With foresight into where prices are heading, our strategies can adjust liquidity bands ahead of time. For example, if a price surge is predicted, the liquidity range can be shifted upward before the price actually moves, ensuring that capital remains in the fee-generating zone.

- Minimized Rebalancing Lag: By reducing the time between a market move and the liquidity adjustment, the integration effectively cuts down on LVR. Liquidity remains aligned with the active trading range, denying arbitrageurs the opportunity to exploit stale positions.

- Balanced Asset Ratios: Proactive rebalancing maintains a near-optimal portfolio mix, mitigating the risk of impermanent loss that typically arises from delayed reactions in volatile markets.

- Dynamic Liquidity Deployment: Predictive feeds allow for a nuanced adjustment of liquidity concentration. In stable conditions, a tighter range can be maintained for higher fee capture; during anticipated volatility, the range can be temporarily widened to reduce the risk of rapid out-of-range events.

In essence, Allora’s predictions equip our liquidity management strategies with a “look-ahead” capability, ensuring that our capital is always deployed where market activity is about to occur.

Deep Dive: Integrating Allora with Steer Protocol’s Strategies

Enhancing the Classic Rebalance Strategy

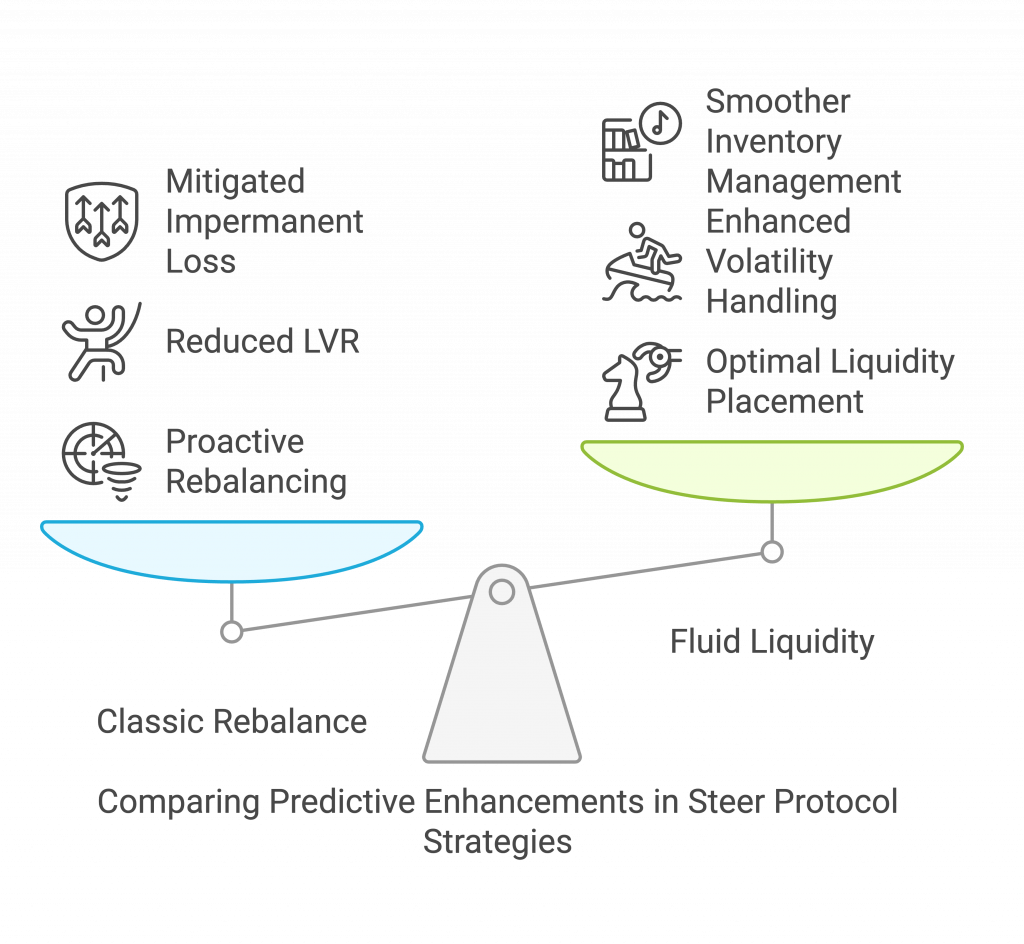

Our Classic Rebalance strategy traditionally centers liquidity around the current market price, periodically rebalancing to restore an optimal asset mix. With Allora’s predictive integration, the process is transformed:

- Anticipatory Rebalancing: Instead of waiting for the price to drift beyond the current range, the strategy can preemptively adjust based on forecasted price movements. This means that if a surge in ETH is expected, the liquidity range is shifted upward ahead of the move, ensuring that fees continue to be captured as the market transitions.

- Lower Adverse Selection: By maintaining liquidity in the anticipated trading region, our approach minimizes the window during which arbitrageurs can exploit outdated prices, thereby reducing LVR.

- Impermanent Loss Mitigation: Preemptive adjustments help keep asset ratios closer to the ideal, preventing the severe imbalances that exacerbate IL.

Advancing the Fluid Liquidity Strategy

Fluid Liquidity is our flagship, inventory-based approach that dynamically adapts to market conditions by managing different liquidity states (balanced, unbalanced, one-sided). The integration of Allora’s predictive signals further refines this strategy:

- Optimal Liquidity Allocation: Instead of solely reacting to changes in the vault’s asset composition, Fluid Liquidity can now position itself in anticipation of where the market is headed. If a market trend is forecasted, liquidity is concentrated within the expected active price zone, ensuring maximum fee capture.

- Adaptive Range Management: Predictive insights allow the strategy to dynamically adjust its range width. In periods of anticipated high volatility, the range can be widened preemptively, reducing the frequency and impact of disruptive rebalances. Conversely, in more stable conditions, a narrower range boosts fee earnings.

- Proactive Inventory Balancing: With AI-guided forecasts, Fluid Liquidity transitions between its operational states more smoothly, maintaining a balanced asset ratio even during rapid market movements. This preemptive inventory management not only minimizes IL but also ensures that the strategy remains in play throughout the market cycle.

Research Insights: Why It Works with v3 Liquidity

Our research into the integration of predictive price feeds with v3 liquidity has revealed several key insights:

- Time-Averaged Capital Efficiency: Concentrated liquidity’s benefits hinge on staying in the money. Predictive rebalancing ensures that liquidity is almost always “in-range,” maximizing fee capture and overall capital efficiency.

- Reduction of Adverse Selection: By preemptively aligning liquidity with forecasted prices, our strategies reduce the arbitrage opportunities that typically arise from reactive adjustments. This leads to a more stable, predictable performance even in turbulent markets.

- Dynamic Adaptability: The synergy between Allora’s forecasts and v3’s concentrated liquidity model creates a dynamic environment where liquidity placement is continuously optimized. This adaptability is crucial in DeFi markets, where conditions can change rapidly.

- Enhanced Risk Management: Proactive repositioning keeps asset balances closer to their ideal ratios, mitigating the severity of impermanent loss. This is especially critical in v3, where the cost of being out-of-range is magnified due to the concentrated nature of liquidity.

- Empirical Validation: Back-testing and simulations indicate that strategies incorporating predictive inputs outperform those relying solely on spot prices—both in fee generation and in minimizing IL and LVR. These improvements, while subtle in calm markets, become significant during periods of rapid price movement.

Conclusion: A New Paradigm in Liquidity Provision

The integration of Allora Network’s predictive price feeds into Steer Protocol’s liquidity strategies represents a significant advancement in how LPs manage their capital in Uniswap v3. By harnessing AI-driven insights, our Classic Rebalance and Fluid Liquidity strategies can reposition proactively, ensuring that liquidity is continuously optimized for fee capture while mitigating the risks of impermanent loss and delayed rebalancing.

This research deep dive demonstrates that the true power of v3 liquidity—its unparalleled capital efficiency—can only be fully realized when combined with proactive, predictive rebalancing. With Allora’s high-accuracy forecasts, we are ushering in a new era where every dollar in the pool is strategically deployed, adaptive, and resilient in the face of market volatility.

At Steer Protocol, our mission is to lead the charge in innovative, data-driven liquidity management. With the integration of Allora’s predictive capabilities, we are proud to offer LPs a toolset that not only keeps pace with the fast-moving DeFi markets but also sets a new standard for efficiency and performance.