The crypto market’s recent momentum—spurred by Bitcoin’s performance—has reignited decentralized finance (DeFi). In early 2024, DeFi entered a “second summer,” with user activity surging. Much of this growth traces back to Bitcoin’s rally (ahead of its halving and ETF news) and renewed capital inflows. Major blockchains began rolling out grant and incentive programs (e.g., Arbitrum’s STIP allocating 50M ARB tokens) to capture liquidity. From Layer-1s to Layer-2s, the race for users and TVL is back on.

Challenges of Traditional Grant Programs

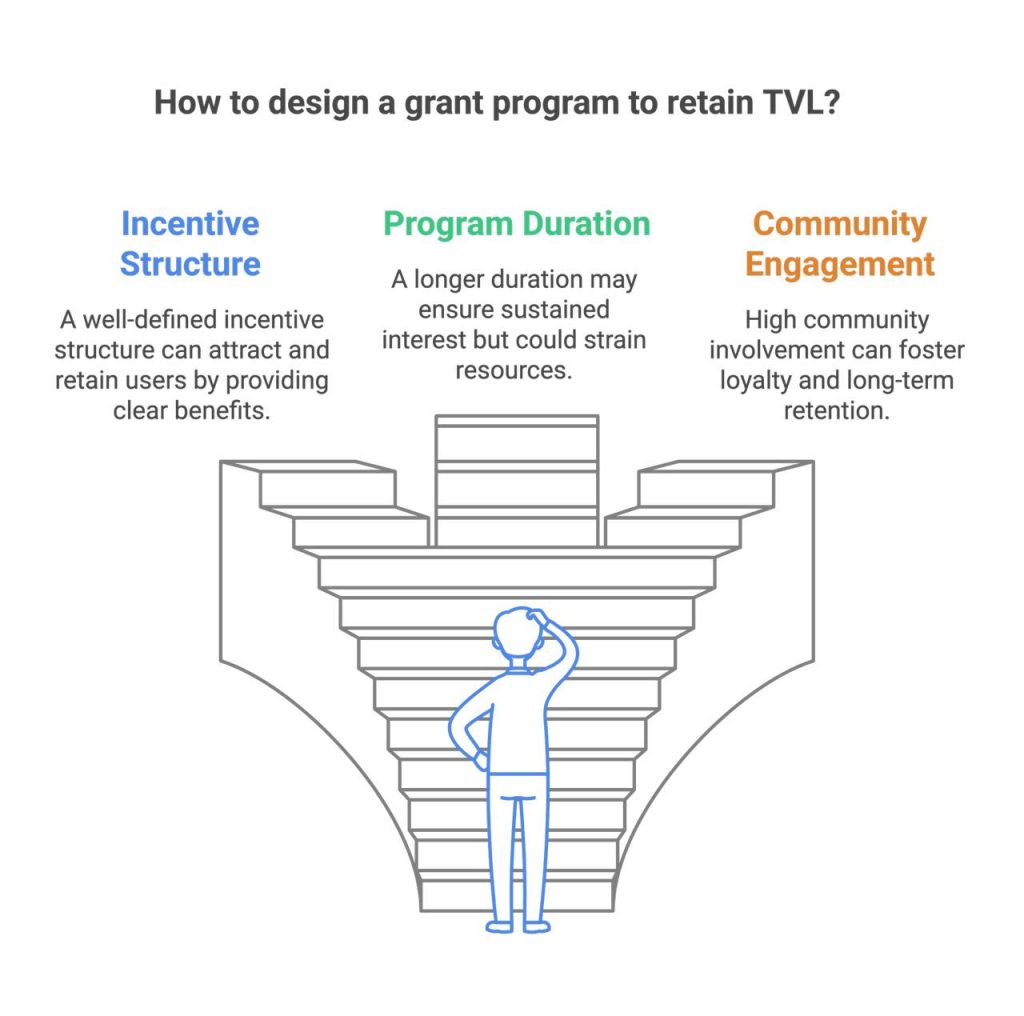

Grant incentives often yield short-lived gains. Mercenary liquidity—where yield farmers exit as soon as rewards stop—causes short-term TVL spikes, followed by outflows. Whale domination also undermines broader impact; large accounts capture outsized rewards, while sybil attackers exploit grants. As a result, programs can see initial usage vanish once emissions dry up.

short-term TVL spikes, followed by outflows. Whale domination also undermines broader impact; large accounts capture outsized rewards, while sybil attackers exploit grants. As a result, programs can see initial usage vanish once emissions dry up.

Arbitrum STIP Case Study: Short-Term Incentives, Short-Lived Gains

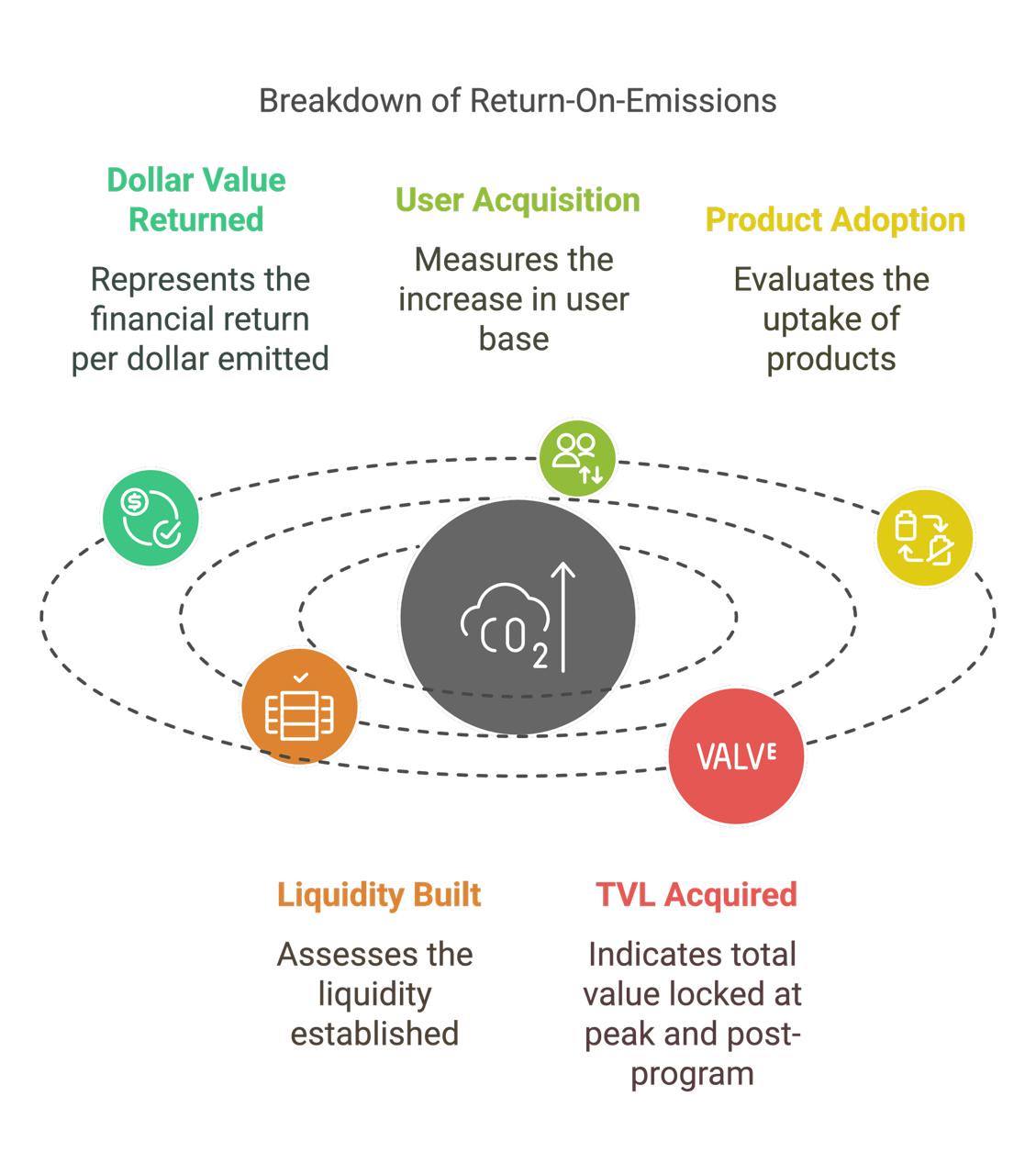

Arbitrum’s Short Term Incentive Program (STIP) illustrates these pitfalls. Fifty million ARB tokens were distributed over five months to boost TVL and on-chain activity. While TVL did rise, much of it was transient. User retention proved weak, and once incentives ended, activity reverted to prior levels. In many cases, a small fraction of the injected tokens translated into lasting TVL (“Return-On-Emissions” or ROE). Moreover, whales and sybil attackers claimed a large portion of the rewards. The result: a short-lived TVL boost but minimal long-term stickiness.

Protocol-Owned Liquidity (POL) Bonds: A Sustainable Alternative

A promising solution is Protocol-Owned Liquidity (POL) via bonding programs. Instead of paying outsiders who leave when incentives end, the protocol itself acquires and permanently owns liquidity. Through bonding, the protocol exchanges incentives for LP tokens, building a treasury of protocol-held assets. This reduces reliance on mercenary capital and aligns incentives for long-term growth.

Savvy’s Experience on Arbitrum

Savvy, a DeFi project on Arbitrum, used part of its ARB grant to launch a bond program, acquiring SVY-ETH LP tokens. This created lasting liquidity for Savvy itself, so when STIP ended, Savvy retained most of its TVL. The reported ROE exceeded 90%, indicating that nearly all the ARB used was converted into protocol-owned liquidity instead of fleeting yield-farming capital.

Implementation Strategy for Blockchain Networks

For large blockchain networks and Layer-1/Layer-2 ecosystems looking to optimize their grant programs, incorporating POL bonds can significantly improve incentive efficiency. Below is a practical framework for doing so, along with a comparison of ROE between traditional liquidity mining and bonding:

- Integrate Bonding into Grant Programs

Require or encourage recipients to allocate a portion of incentives to bonding. This shifts from renting liquidity to owning it. Tools like Lucid’s Vested Emissions Offerings (VEOs), an institutional-grade, scalable solution, can facilitate this exchange of tokens for LP shares. - Incentivize Long-Term Participation

Use lockups or bonus rewards for liquidity that remains after campaigns end, nudging farmers to become longer-term stakeholders.

- Use ROE as a Key Metric

Evaluate proposals by how much lasting TVL or volume persists per token spent. Bonding has shown higher ROE (sometimes >85%) compared to single-digit ROE in standard liquidity mining. - Provide Bonding Support & Infrastructure

Offer templates and tools so projects can easily spin up bonding programs without heavy technical overhead.

- Monitor and Iterate

Track metrics like TVL retention, user activity, and ROE. Adjust future grant waves accordingly.

Compared to traditional liquidity mining, bonding programs “lock in” a significant share of the value created. Savvy retained ~95% of its incentive-based liquidity via POL, whereas many non-bonding projects see near-0% retention.

Last Word

As DeFi enters a renewed growth phase, blockchains must move beyond subsidy-driven TVL spikes and embrace more durable approaches. Protocol-owned liquidity via bonding offers a path to sustainable ecosystem growth, converting short-term token emissions into long-term infrastructure. By designing incentives around high ROE, blockchains can create lasting liquidity that remains even when grants end. It’s time to replace mercenary mining with a more sustainable playbook.

Call to Action

Blockchain networks and DeFi protocols should incorporate bonding models into their grant programs and measure results with metrics like ROE. The next wave of DeFi expansion should leave behind fleeting yield farmers and focus on stable, protocol-owned liquidity. If you’re looking to implement these strategies, reach out to discuss how bonding could transform your incentives and multiply your network’s growth.