In the volatile world of DeFi, managing large token positions is a delicate balancing act. Whether you’re a trader, a DeFi protocol, or a grant recipient holding a hefty allocation of tokens, you face a common challenge: how to divest or accumulate assets sustainably without crashing the market or missing out on gains. Dumping a large bag of tokens on a DEX can tank the price, while sitting idle or buying in one swoop can be equally suboptimal.

Steer Protocol’s Smart Pool Strategies provide an elegant solution – enabling you to gradually sell or acquire assets without impacting market conditions, all while earning passive yield. In this article, we explore how Steer’s advanced strategies make this possible, and break down three key approaches: DCA with Liquidity Curves, Fluid Liquidity, and Accumulate. Each strategy combines automation, liquidity provision, and smart execution to help you trade smarter and more profitably. (Spoiler: you’ll also see how grant recipients can put their tokens to work instead of letting them gather dust!)

Converting Assets without Shocking the Market with Smart Pools

Steer’s Smart Pools are essentially automated, algorithm-driven vaults that manage liquidity positions on your behalf. Instead of executing a giant market order, a Smart Pool splits your transactions into many small moves over time and price ranges. This means large divestments or acquisitions happen bit by bit, giving the market time to absorb your trades. As a result, you avoid the massive slippage and price distortions that come from all-at-once trades. In traditional trading, it’s well known that breaking up a large order into smaller tranches over time can significantly lessen market impact . Steer takes this concept to the next level by using liquidity positions (rather than repeated manual orders) to achieve the same goal, plus earn you fees on each incremental swap!

How is this possible? Steer’s multi-position liquidity engine allows each vault to hold multiple concentrated liquidity positions simultaneously. In simple terms, your assets can be spread across various price ranges or “tranches” in an AMM pool. By cleverly distributing liquidity in shapes defined by Steer’s Curves Library, the vault can implement sophisticated strategies (created by Steer or even custom-built by users) to execute something like dollar-cost-averaging, rebalancing, or limit orders all within one automated pool.

You set the strategy (or pick from Steer’s strategy marketplace), deposit your tokens, and the Smart Pool takes over – continuously managing your liquidity to follow the strategy’s rules. The outcome is a sustainable, gradual transition of assets: whether you need to divest from a large position or accumulate a new asset, it happens algorithmically over time with minimal market disruption. And as a bonus, those small swaps happening via your liquidity positions are accruing trading fee revenue for you along the way.

Let’s dive into the three flagship strategies that make this possible, and how each can benefit different scenarios.

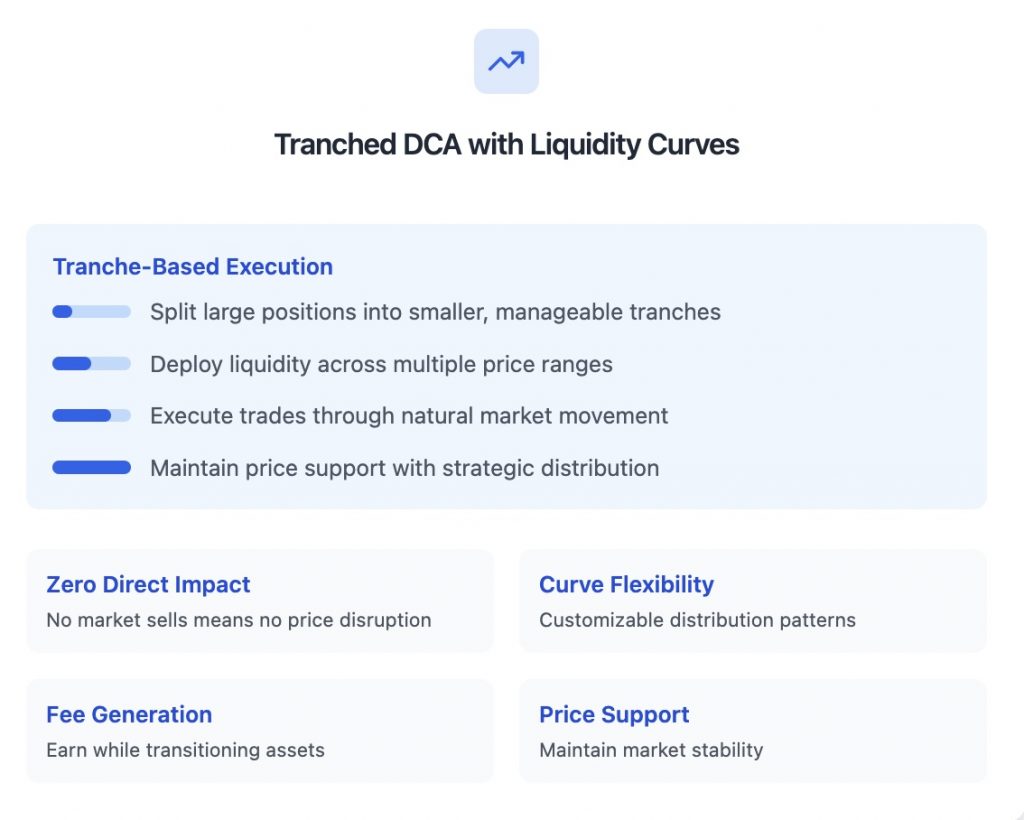

1. Tranch Dollar-Cost Averaging (DCA) with Liquidity Curves

Most crypto veterans are familiar with DCA – investing or divesting a fixed amount at regular intervals to average out your price. Steer’s Smart Pools bring DCA to liquidity provisioning. Instead of executing discrete trades on a schedule, you deposit assets into a curved liquidity position that naturally executes the DCA as the market moves. This approach is like automated micro-trading through liquidity, leveraging concentrated liquidity style range orders in the background (where one asset is gradually converted to the other as price moves).

Example: Linear Time-Based Strategy: One of Steer’s DCA techniques uses a curved linear distribution of liquidity across a price range, combined with time-based adjustments. In practice, this means your liquidity is initially spread in a linear slope within a certain price band between two assets. Over static time intervals (say daily or weekly), the strategy shifts this liquidity range downward or upward, incrementally migrating your liquidity from one token to the other. As the market price moves into each portion of your liquidity range, a small part of your position converts (one asset for the other) at that market rate. Essentially, you’re slicing a big swap into many tiny swaps happening continuously. By leveraging natural price movement, the strategy aims for optimal divestment: you sell tokens bit by bit at varying price points (often catching higher prices for sells, or lower prices for buys) instead of a single average price. The result is a smoother exit that avoids dumping pressure on the market.

DCA Execution via Steer’s Curves Library: Steer’s infrastructure makes this process powerful and customizable. Using the built-in liquidity curves library, a DCA strategy can deploy multiple tranches of liquidity positions across different price ranges or time triggers. For example, if you have a large amount of Token A to gradually trade for Token B, the strategy might create a series of narrow liquidity positions at incremental price levels (a ladder of “mini” range orders). Each tranche is programmed to activate or shift over time, ensuring the market gradually absorbs your liquidity instead of being hit with one large sell order . Because Steer vaults support multiple simultaneous positions, all these tranches work in parallel within one vault . You effectively execute a time-weighted average price strategy (TWAP) without manual intervention.

What’s the benefit? You achieve a better average price for your trade and minimize slippage, as no single trade is big enough to move the market significantly. Moreover, unlike a typical DCA where idle funds might sit between buys, here every portion of your liquidity is earning fees while it’s waiting to execute. The DEX traders who take the other side of your gradual sales are paying you trading fees – turning your DCA into an income-generating strategy. This is ideal for traders or treasury managers who need to unwind large positions quietly. Instead of announcing your sells to the market (and front-running yourself), you let the Smart Pool silently drip your liquidity out. Patience pays, quite literally, and once the strategy completes, you’ll have successfully divested or acquired your target asset with minimal fuss. (If you’re curious about setting up a custom DCA curve for your specific needs, the Steer team can help you configure the perfect strategy.)

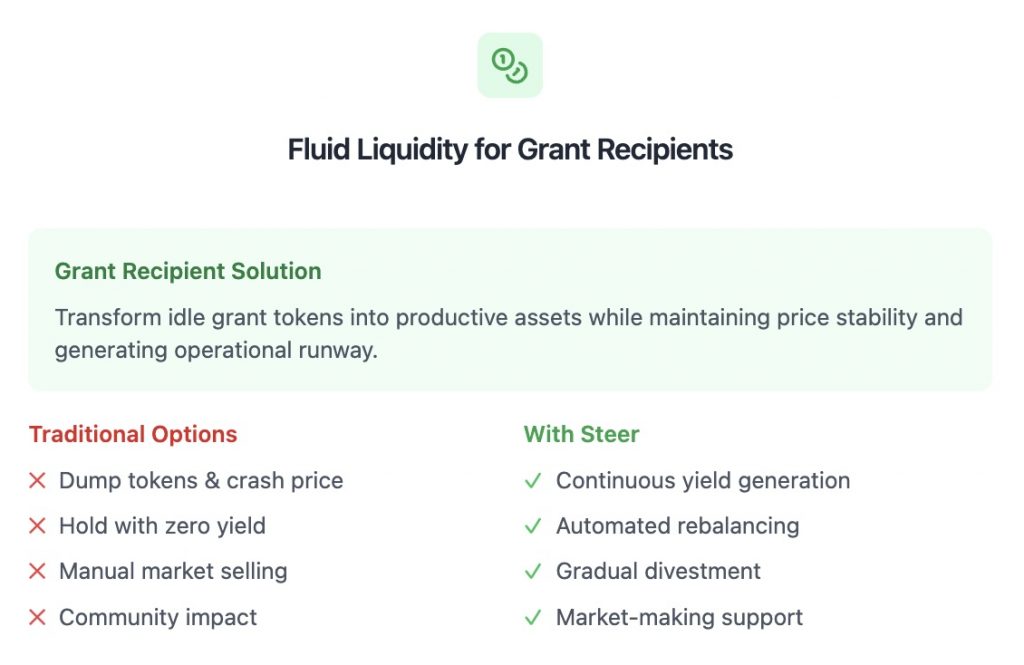

Earn Passive Yield on Idle Tokens – Fluid Liquidity Strategy

If you’ve ever provided liquidity on a DEX, you know the headache of constant monitoring and rebalancing to avoid impermanent loss. Grant recipients and protocols often find themselves holding large amounts of a token that they plan to slowly liquidate or utilize. The Fluid Liquidity Strategy was designed for situations just like this: it maintains an ideal asset ratio in a liquidity pool while optimizing for fee generation. In other words, it lets you park a big token position into a liquidity vault and earn passive yield, without having to babysit the pool 24/7.

At its core, Fluid Liquidity is an adaptive liquidity management strategy. It dynamically adjusts your positions to keep a target balance between the two assets in the pool . For example, you might set a 50/50 ratio between your grant token and USDC. The strategy will automatically provide liquidity around the current price and continuously rebalance towards that 50/50 value ratio as the market moves. It operates in three modes or states – default (balanced), unbalanced, and one-sided – depending on how far the current ratio drifts from your ideal. If your token suddenly pumps and your vault now holds more value in that token than the stablecoin, Fluid Liquidity will recognize an unbalanced state. It might then widen the liquidity range or use a portion of the excess token to rebalance (by effectively selling a bit into fees) until the ratio normalizes. Conversely, if your token price drops (making your holdings underweight relative to stablecoin), the strategy can enter a one-sided state where it concentrates liquidity to accumulate more of the token (buying low) and restore balance. All of this happens algorithmically, without ever performing a direct swap. The strategy uses liquidity adjustments to nudge the portfolio back to equilibrium, capturing trading fees in the process and mitigating impermanent loss through its dynamic repositioning .

Maintaining the Ideal Ratio (and Earning Fees): The key advantage here is automation and risk management. Fluid Liquidity keeps your asset allocation on target without manual trades, which is a lifesaver for grant recipients who can’t constantly watch the market. By staying close to your chosen ratio, you reduce exposure to extreme swings (selling a bit when your token’s price is too high, buying back when it’s low) – effectively a buy-low, sell-high rebalancing pattern. Every rebalance action is achieved by adjusting liquidity, so you are earning fees whenever traders interact with your liquidity. This translates to a steady stream of passive yield on your grant or treasury tokens, helping offset any impermanent loss and often even increasing your stack. In fact, the strategy excels in capturing fees across all sorts of market conditions because it always ensures some liquidity is at work in the active price range . It’s like having a money manager that tirelessly optimizes your pool for you: if markets are calm, it holds a balanced position to collect fees; if markets move, it shifts just enough to grab opportunity and then returns to balance.

“Holding Pattern” for Fee Maximization: A clever aspect of Fluid Liquidity is knowing when not to trade. If the asset ratio is within an acceptable band around your ideal, the strategy doesn’t overreact. It can sit in a default state (balanced) – essentially a holding pattern – where it simply keeps your liquidity around the current price, maximizing fee collection. There’s no needless rebalancing until a real imbalance occurs. This prevents excessive trading (and unnecessary gas or potential IL) and lets your capital work efficiently. The end result is a strategy that is both responsive and conservative as needed, squeezing out fees while protecting your portfolio’s composition.

Use Case – Grant Recipients: To see Fluid Liquidity’s value, consider a grant recipient who received a large amount of their project’s native token. Rather than dumping tokens on the market (harming the token’s price and community), or just holding them with zero yield, they can deploy those tokens into a Steer Fluid Liquidity vault paired with a stablecoin or ETH. Now the grant tokens become productive: the vault continuously market-makes with them, earning fees from every swap on that pair. The ideal ratio can be set to gradually divest some tokens for stablecoins – providing the project with operational funding over time – while still maintaining significant exposure. If the token appreciates, the vault sells a bit into the strength (securing more stablecoins at good prices); if it dips, the vault buys some back (increasing token holdings) – all autonomously. Importantly, these adjustments happen via liquidity providing, so the project is slowly unloading or loading up based on market activity, without causing sudden dumps. It’s a win-win: the market doesn’t panic, and the grant recipient gains a stream of passive income and a controlled way to realize value. Many DeFi protocols with treasuries use similar strategies to safely manage runway. And because Steer’s Smart Pools are highly configurable, the team can fine-tune parameters (ideal ratios, range widths, etc.) to fit each project’s risk profile. If you’re sitting on a large token allocation (from a grant or otherwise), Fluid Liquidity is a game-changer to put those tokens to work while executing a responsible divestment plan. (Pro tip: Steer’s team is happy to discuss customizing a Fluid strategy for your needs – just reach out and we’ll help you get set up!)

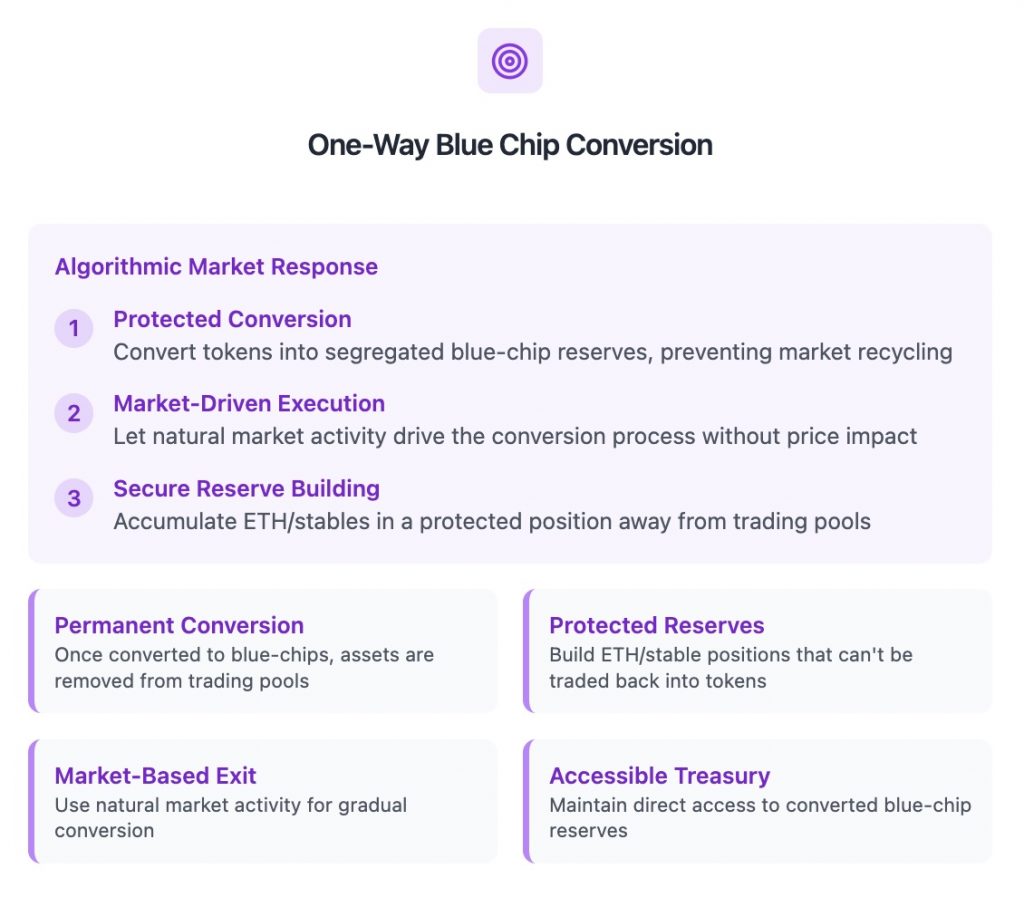

Accumulate Strategy – One-Way Selling to Build Your Blue Chip Position

Sometimes your goal is not to maintain a ratio or evenly swap assets, but rather to convert one asset entirely into another over time. Enter the Accumulate Strategy – a one-way sell approach that allows you to gradually pull in blue-chip assets (like ETH, BTC, or stablecoins) from the market in exchange for another token you hold, guided by price action. This strategy is perfect for protocols or investors who have a large position in Token X and ultimately want to hold Token Y, but who wish to do so strategically and gradually rather than via a single trade.

How it Works: You start by depositing only the asset you want to sell (Token X) into a Smart Pool vault that’s configured for accumulation. The vault then places this liquidity in a one-sided range in the Token X–Token Y pool – essentially setting up numerous tiny “sell orders” for X at various price points to acquire Y. As the market price of X vs Y fluctuates and hits those ranges, portions of your Token X are traded away and converted into Token Y automatically. This process continues until eventually most (or all) of your original Token X has been swapped for Y, without you ever executing a traditional swap directly. It’s the same concept that Uniswap v3 introduced with range orders, where providing single-sided liquidity in a range allows you to swap into the other token as the price moves through that range . In fact, one can think of Accumulate Strategy as stacking a series of range orders, tuned to trigger based on price action criteria you set.

What makes this accumulation approach so powerful is that it waits for the market to come to you. Instead of market selling Token X at any price you can get right now, you define the price bands or conditions under which you’re willing to trade. For example, you might configure the vault to sell your Token X only when its price is above a certain threshold (meaning you get more Y per X), or to spread sales across an upward price curve. The strategy might use a trailing range that follows the market up, always staying just above current price – so it continuously feeds small amounts of X into the market as buy pressure for Y exists. This way, if a rally happens, you take full advantage by selling incrementally into strength. If the price stagnates or dips, your remaining X stays put (and even earns fees in the meantime), rather than being sold at a low. Essentially, price action triggers your sales. Over time, you accumulate your target asset (Y) at favorable rates, and because each sale was just a bite-sized chunk of liquidity, the market hardly notices. There’s no large red candle from your selling; it’s all smooth and under the radar.

Why it’s Beneficial: The Accumulate Strategy is the mirror image of DCA – here you’re exiting one asset for another, but using the same disciplined, gradual methodology. You avoid the “market impact” of a big swap, getting a better average price for your exit. In fact, this approach can often achieve something close to the best-case execution, similar to a TWAP algorithm that executes over hours or days . Moreover, because your orders are sitting as liquidity in the pool, you earn trading fees whenever anyone trades in those price ranges. Those fees effectively bonus you with extra of asset Y (or some of X), increasing your overall gains. For instance, if you’re accumulating a blue-chip like ETH using this strategy, you might end up not only with the ETH from selling your tokens, but also additional ETH from fees earned while waiting for each sale to execute. It’s a savvy way for protocols to convert treasury tokens into more stable assets or for individuals to build up positions in major assets, all on autopilot. And just like the other strategies, Steer’s Smart Pool framework means you can customize the accumulation parameters or combine them with other tactics. It’s flexible: you could accumulate in one direction and even set a small rebalancing threshold to pause if certain conditions are met – the possibilities are endless.

Bottom line: The Accumulate Strategy lets you ride the market’s waves to shore, rather than swimming against the current. By the end, you’ve smoothly transitioned into your desired asset with minimal slippage and maximum profit extraction. If accumulating blue-chips or stabilizing your holdings is on your agenda, this strategy deserves a closer look.

Embrace Smarter Liquidity Management with Steer

In summary, Steer Protocol’s Smart Pool Strategies empower you to do things that simply aren’t possible with a DIY approach on regular exchanges. Whether you need to steadily divest a position, deploy idle tokens to earn yield, or accumulate an asset over time, these strategies have you covered. The common thread is control and efficiency: you stay in the driver’s seat of how and when your trades execute, all while the automated vault works tirelessly in the background. Instead of reacting to the market, you set the course and let the strategy navigate the ups and downs for you. The benefits are clear:

- Minimal Market Impact: By trading in bite-sized pieces and leveraging liquidity positions, you avoid slippage and large price swings that could work against you . Your actions are sustainable and stealthy, keeping markets stable and prices fair for everyone.

- Optimized Yields: Why forego potential income? All three strategies turn your trading into an opportunity to earn fees. You effectively get paid to execute your strategy, boosting your overall returns. Fluid Liquidity, in particular, is built to maximize fee capture in all conditions , and even the DCA/Accumulate approaches rake in fees as a side benefit.

- Automated Discipline: Emotion and timing mistakes are taken out of the equation. The strategies stick to the plan – whether it’s a time-based DCA or a rule-based rebalancing – so you don’t fall victim to fear or greed. This disciplined approach often achieves better results than trying to time the market manually.

- Customizable & Proven: Steer’s platform offers a range of pre-built strategy templates (like the ones described here) that have been battle-tested. Yet, each can be adjusted to fit your needs, or you can even work with the Steer team to design a bespoke strategy. The underlying engine is powerful and flexible , meaning if you can dream up a liquidity strategy, Steer can likely implement it. This opens the door for DeFi protocols to manage treasury liquidity in innovative ways, and for advanced traders to execute strategies typically reserved for quants.

- Hands-Off Yield for Grant Holders: A special mention for grant recipients and project teams: Smart Pools let you earn passive income on your tokens from day one. No more idle treasury funds. You can support your token’s market by adding liquidity strategically (via Fluid or DCA strategies) and generate APR on top of it, all while gradually converting tokens to stable assets to fund development. It’s like having a self-driving market maker working for your project 24/7.

Ready to leverage these benefits? Steer Protocol makes it easy to get started. You can explore existing strategy vaults through our intuitive dashboard or even launch a new Smart Pool with just a few clicks. The days of choosing between dumping tokens and doing nothing are over – now you have a smarter third option! If you’re intrigued by any of these strategies or wonder how they might apply to your situation, reach out to the Steer team. We’re passionate about helping our community trade smarter and manage liquidity more effectively. Whether you’re a trader looking to optimize returns or a protocol aiming to bolster your token’s market, we’d love to chat about solutions.

Empower your trades with Steer’s Smart Pools and watch your strategy unfold on autopilot. Get in touch with us today to start your journey toward sustainable, profitable liquidity management! 🚀