Decentralized finance (DeFi) is evolving at breakneck speed, especially in handling liquidity. Automated Market Makers (AMMs) have moved from simple constant-product pools to more advanced Concentrated Liquidity AMMs (CLAMMs) that turbocharge capital efficiency. In this post, we’ll explore the rise of CLAMMs and why Steer Smart Pools stand out as the premier Dynamic Liquidity Market Making (DLMM) solution for liquidity providers (LPs), DeFi investors, and developers alike.

Market Trends & Insights: The Rise of CLAMMs in DeFi

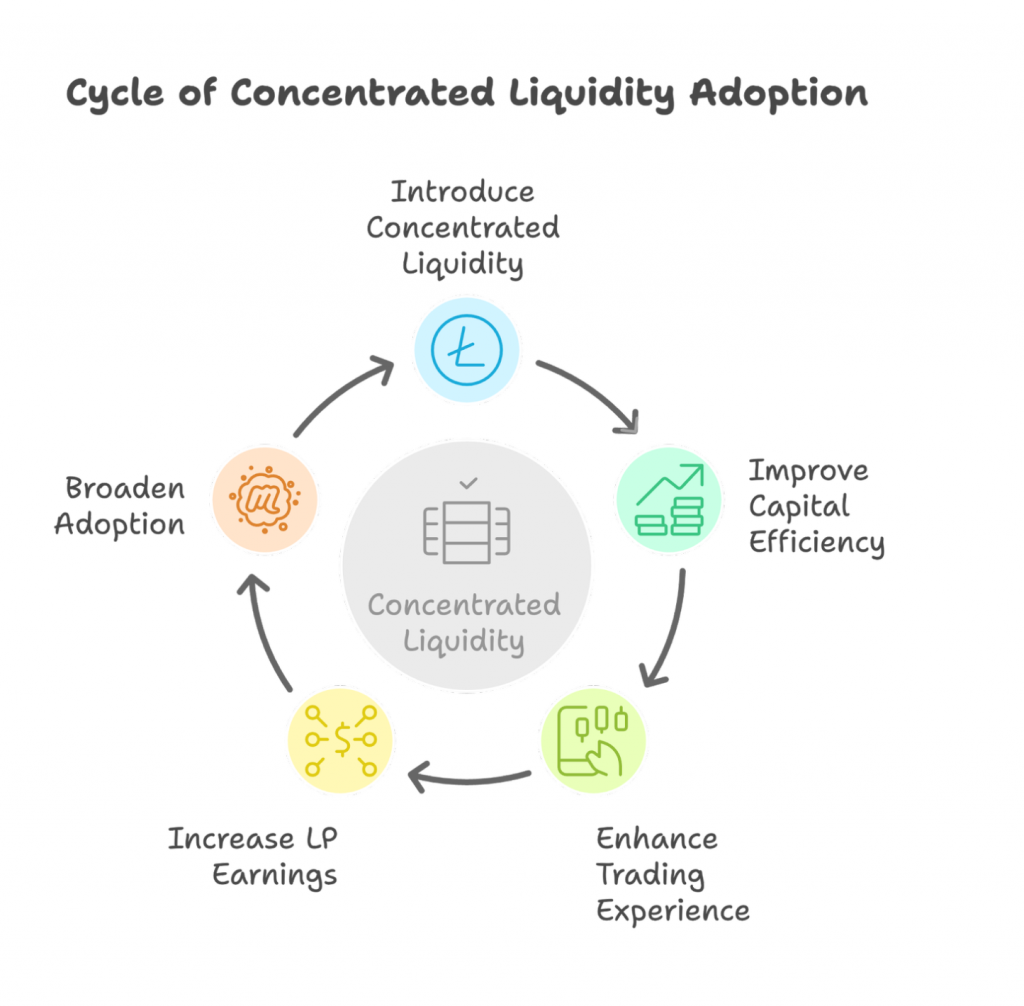

Not long ago, most AMMs (like Uniswap v2) required LPs to spread liquidity across the entire price spectrum, which was highly inefficient. The introduction of Uniswap v3 in 2021 changed the game by letting LPs concentrate liquidity in specific price ranges. This CLAMM model has quickly caught on across the DeFi landscape:

“Spearheaded by Uniswap’s V3 AMM model, concentrated liquidity has proven to be the most efficient DEX model so far. This year alone, numerous (prominent) DEXs have signaled their intentions to launch a concentrated liquidity model. Orca of Solana, Trader Joe of Avalanche and Quickswap of Polygon, just to name the top brass.” (Concentrated Liquidity | StellaSwap)

In other words, concentrated liquidity is becoming the norm. Major exchanges on Ethereum, Solana, Avalanche, Polygon, and beyond have adopted or plan to adopt CLAMMs to improve their trading platforms. The reason is clear: CLAMMs dramatically boost how effectively liquidity is used, leading to better trading experiences and more earnings for LPs. For example, Uniswap v3 allows LPs to provide liquidity with up to 4,000× capital efficiency relative to Uniswap v2 (Introducing Uniswap v3) This means a liquidity pool can facilitate the same trade volume with a fraction of the capital, thanks to LPs focusing their funds where the market is active.

Equally important, CLAMMs have impacted liquidity provision by reducing trade slippage and increasing fee revenues. Traders get better prices because liquidity is dense around the current price, and LPs put their assets to work more effectively instead of having most of it sit idle in unused price ranges. It’s no surprise that concentrated liquidity designs are growing in popularity, with an ever-expanding share of DEX trading volume flowing through CLAMM-style pools.

What CLAMMs Enable for Liquidity Providers

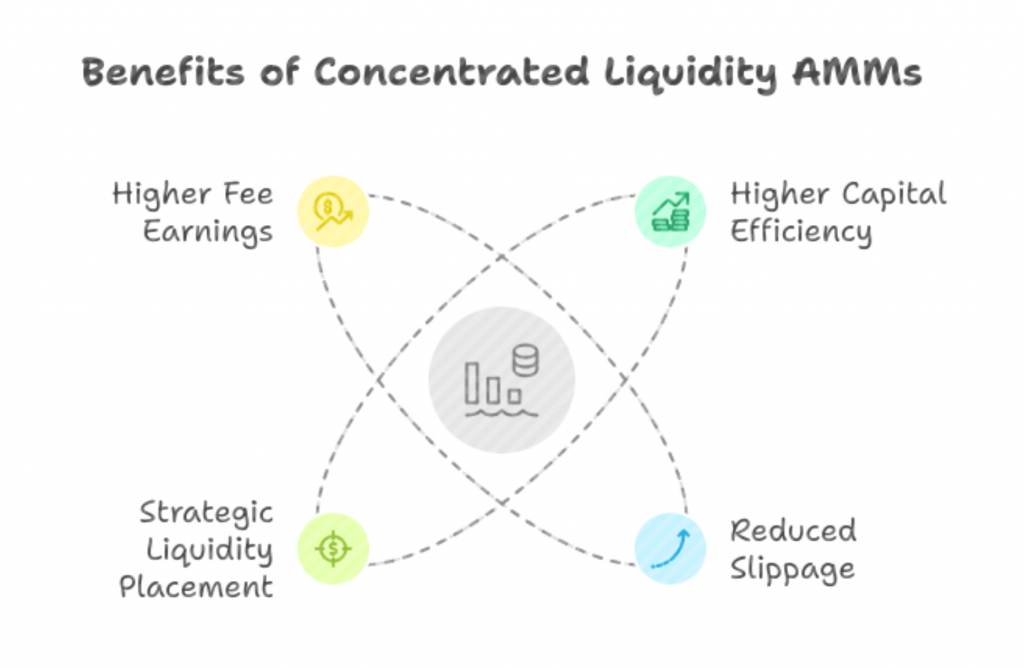

Concentrated Liquidity AMMs unlock several key benefits that traditional AMMs couldn’t offer:

- Higher Capital Efficiency: By confining liquidity to a chosen price range, LPs earn fees on a much larger portion of their capital. In fact, concentrating liquidity can make capital up to 4,000 times more efficient compared to standard AMM. A smaller amount of liquidity, when properly positioned, can support the same trade volume as a vastly larger pool in a traditional AMM. This translates to higher ROI on deposited assets.

- Reduced Slippage: Trades execute with less price impact because liquidity isn’t spread thin. Instead, it’s aggregated where most trading happens (near the current price). This deep liquidity around the market price means even large trades clear closer to the expected price, often rivaling the low slippage seen on centralized exchanges

- Strategic Liquidity Placement: LPs gain granular control over where their capital is active. You can concentrate liquidity in a narrow range if you expect the price to stay bounded (earning more fees if you’re right), or spread it wider to cover more volatility. You can even effectively set limit orders – for instance, by placing liquidity entirely above the current price, an LP can sell one asset for another as the price rises, earning fees in the process. This flexibility allows for sophisticated, customized strategies rather than a one-size-fits-all pool.

- Higher Fee Earnings: With capital efficiency and low slippage comes greater trading volume and fee generation per dollar of liquidity. Because trades gravitate to pools where they get the best price, CLAMM pools tend to attract more volume. LPs who actively manage their ranges can significantly boost their fee income compared to passive, spread-out liquidity in older AMMs.

In summary, CLAMMs empower liquidity providers to do more with less. They concentrate the power of their liquidity, resulting in a win-win: traders get better prices, and LPs earn more from the same capital. However, this comes at the cost of active management – which is where the next evolution, dynamic liquidity management, enters the scene.

Steer Smart Pools – Going Beyond Traditional CLAMMs

While CLAMMs are powerful, they also introduce new challenges. Liquidity that’s too concentrated needs to be actively adjusted; otherwise, an LP’s position can fall out of range and stop earning fees entirely.

In other words, if the market moves beyond the boundaries of a concentrated position, that liquidity is doing nothing until it’s repositioned. Manually tracking and rebalancing positions can be tedious and costly (in gas fees and time). This pain point gave rise to Dynamic Liquidity Management solutions (sometimes called DLMMs) which automate the process of adjusting liquidity ranges. Among these, Steer Smart Pools have emerged as a premier choice for taking concentrated liquidity to the next level by allowing dynamic liquidity shaping and continuous rebalancing beyond what standard CLAMMs or other DLMM protocols offer.

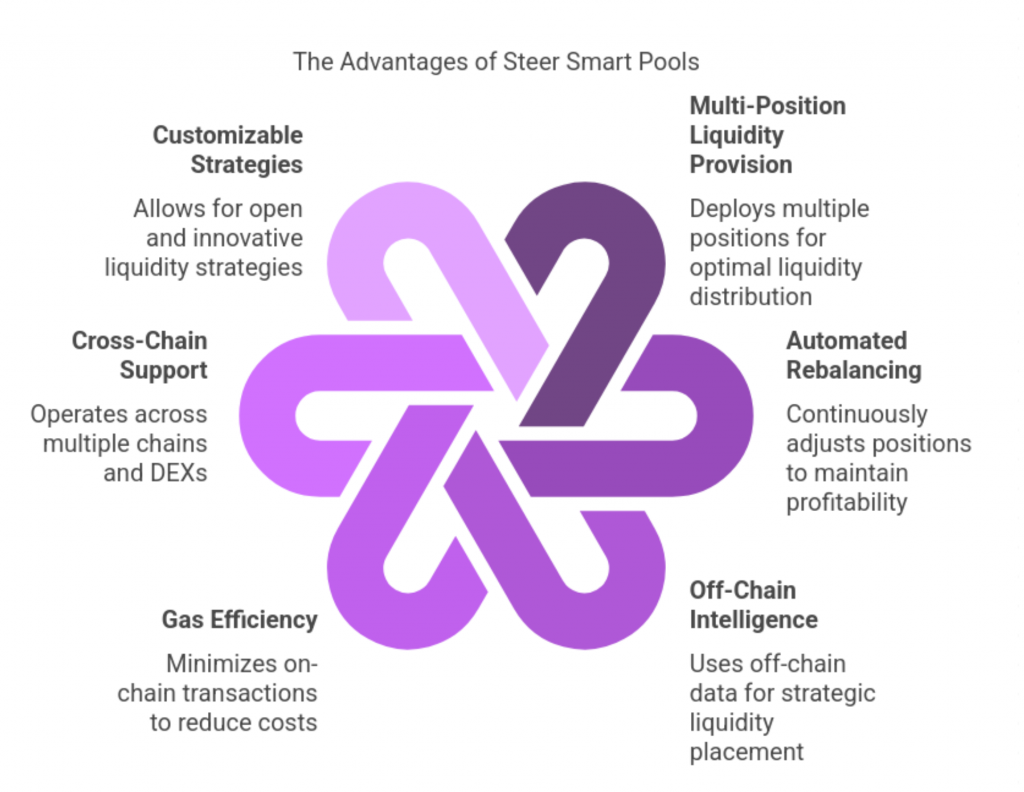

So what makes Steer Smart Pools special? Steer effectively acts as an Active Liquidity Manager (ALM) on top of CLAMM platforms. It automates the hard parts of being an LP in concentrated pools. Here are a few of the standout advantages of Steer Smart Pools over traditional CLAMMs (and other automated managers):

- Multi-Position Liquidity Provision: Instead of a single concentrated position, Steer can deploy multiple liquidity positions simultaneously within a pool. A Steer Smart Pool strategy can manage *20+ distinct positions at on (Smart Pools | Steer Protocol). This means your liquidity can be spread across various price intervals, creating a custom liquidity curve rather than a single interval. By shaping liquidity in this way, Steer ensures that at least some portion of your capital is always optimally placed, even as markets move. One narrow range might be centered at the current price for high fee capture, while other wider ranges stand ready to catch larger swings – all handled for you.

- Automated Rebalancing: Steer continuously monitors market conditions and automatically rebalances those positions. If the price starts to drift, Steer will adjust the liquidity distribution – widening or shifting ranges, adding new positions ahead of the price, or closing those left behind. This dynamic rebalancing keeps liquidity active within the profitable zones at all times, mitigating the “out-of-range” issue that plagues static LPs. Essentially, Smart Pools move with the market so you don’t have to. As Steer’s founder Derek Barrera describes it, the system can even anticipate price movements:

“…we can place liquidity, which looks like books on — let’s say a centralized exchange — which allows us to capture that price movement before it actually might happen on-chain,” said Derek Barrera, founder of Smart P

ools (Sushi’s ‘Smart Pools’ hope to boost LP efficiency – Blockworks). By preemptively adjusting positions (much like an order book shifts in expectation of trades), Steer Smart Pools can capture opportunities that a reactive or on-chain-only strategy might miss.

- Off-Chain Intelligence and Optimization: Steer’s architecture leverages off-chain computation to make smart decisions about liquidity placement. The strategy logic isn’t limited by on-chain program constraints – it can pull in real-time data and run complex algorithms in an off-chain environment, then execute optimal adjustments on-chain. Steer Protocol’s infrastructure allows for logic to be run off the chain, with both on and off-chain data available to use, whether it is processing trading data, market KPIs, or anything you might want to factor, this means Steer strategies can consider factors like volatility, trading volume, price trends, or even off-chain signals when rebalancing, giving it an edge in responsiveness and precision. Other DLMMs typically rely on simpler on-chain rules or preset parameters without this level of intelligence.

- Gas Efficiency and Cost Savings: By handling calculations and strategy logic off-chain, Steer minimizes on-chain transactions. LPs share a vault and costs, so instead of each user individually moving their Uniswap v3 positions (and paying gas each time), the Smart Pool bundles capital and makes batched adjustments only when needed. This design significantly *reduces gas costs for rebalance, making active management economically viable even on networks like Ethereum. Competing approaches that adjust liquidity on-chain with every swap or on a preset schedule can rack up costs or face performance limits – Steer avoids that by smart timing and bundling updates.

- Cross-Chain and Multi-DEX Support: Steer is platform-agnostic. It isn’t an AMM itself, but rather a liquidity manager that plugs into many popular CLAMM-based DEXs. As of now, Steer’s Smart Pools operate across 37+ chains and 45+ different DEX – from Ethereum mainnet and Layer-2s to alternative chains. Whether it’s Uniswap v3, SushiSwap, QuickSwap, Camelot, or others, chances are Steer can manage liquidity there. This far outstrips the reach of most competitor DLMM protocols, which tend to be tied to one chain or a single DEX ecosystem.

- Open and Customizable Platform: Unlike one-size automated strategies, Steer is an open, permissionless platform for liquidity management. Anyone can build and deploy custom strategy “apps” on Smart Pools or choose from a library of proven strategies. This fosters innovation and means LPs aren’t limited to a single approach – they can pick a Smart Pool strategy that matches their risk/return preference or even develop their own. Other protocols typically offer a fixed mechanism (for example, Maverick’s predefined modes, or a fixed strategy run by the protocol team). Steer’s flexibility ensures that as market conditions evolve, strategies can evolve too. Developers and protocols can leverage Steer’s SDK and App Store of strategies to fine-tune how liquidity is provided, unlocking use-cases beyond what a monolithic AMM can do.

All these advantages position Steer Smart Pools a cut above the rest in the DLMM space. It’s essentially Concentrated Liquidity 2.0 – combining the efficiency of CLAMMs with intelligent automation and cross-platform reach. To illustrate this, let’s compare Steer head-to-head with some other notable dynamic liquidity solutions.

Steer vs Other DLMMs: Feature Comparison

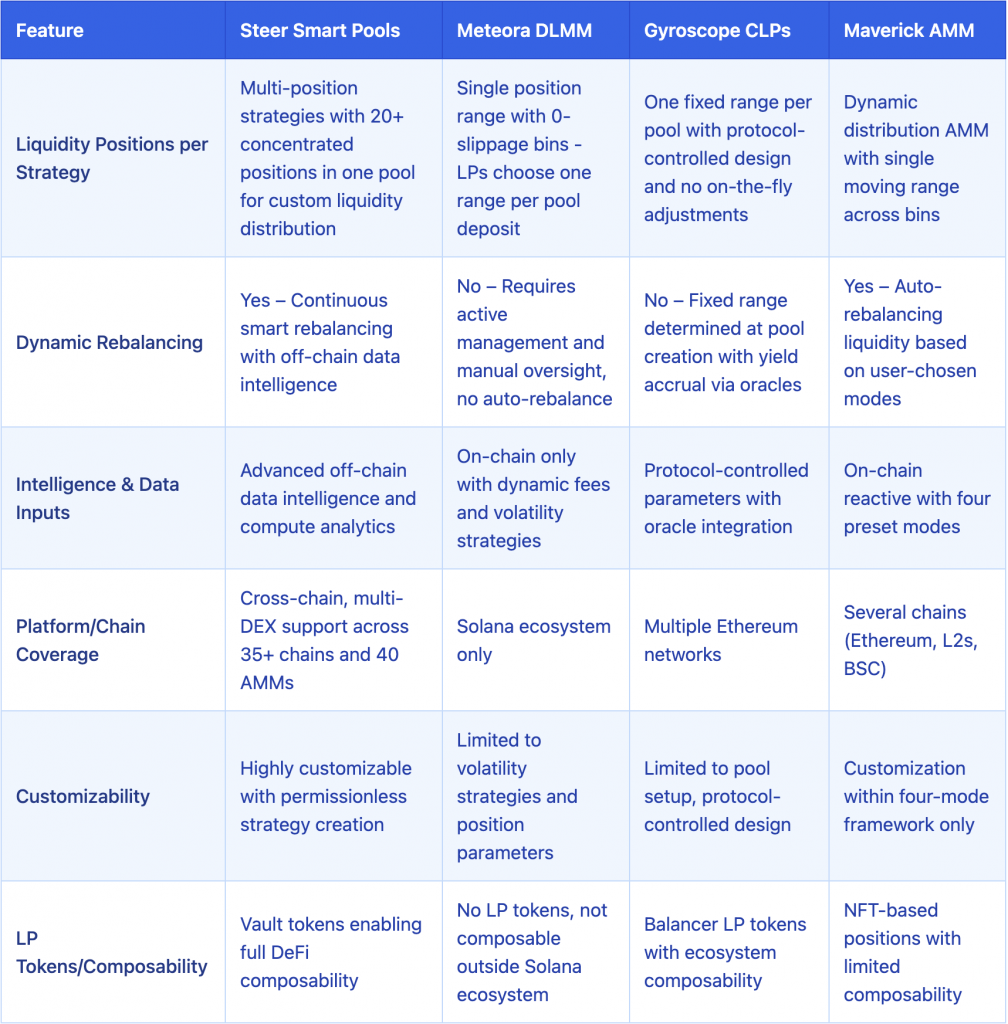

Several projects have emerged to help LPs manage concentrated liquidity dynamically – each with different approaches. The table below compares Steer Smart Pools with three other well-known DLMM implementations:

- Gyroscope (which built novel concentrated pool types on Ethereum)

- Maverick Protocol (an Ethereum/zkSync AMM with auto-adjusting liquidity)

We’ll compare key features and limitations:

Table: Feature-by-feature comparison of Steer Smart Pools vs. other Dynamic Liquidity Market Makers.

As shown above, Steer excels in flexibility and scope, whereas other solutions have notable constraints. Gyroscope innovated with single-range concentrated pools ideal for stable assets, yet by design it forgoes multi-range flexibility – it’s optimized for simplicity rather than active management. Maverick Protocol introduced automated liquidity movement, but its fixed modes and limited chain deployment mean it cannot match the cross-chain, customizable strategies that Steer has. In contrast, Steer Smart Pools combine all the strengths – multi-range concentration, automated rebalancing, intelligent strategy, and broad accessibility – without the weaknesses that limit other DLMMs.

Liquidity Efficiency Breakdown: Dynamic Allocation & Rebalancing

Let’s dive a bit deeper into how Steer Smart Pools actually manage to keep liquidity so efficient. The secret lies in how liquidity is allocated across multiple positions and how it’s continuously rebalanced to optimize returns. Here’s a simplified breakdown of the process:

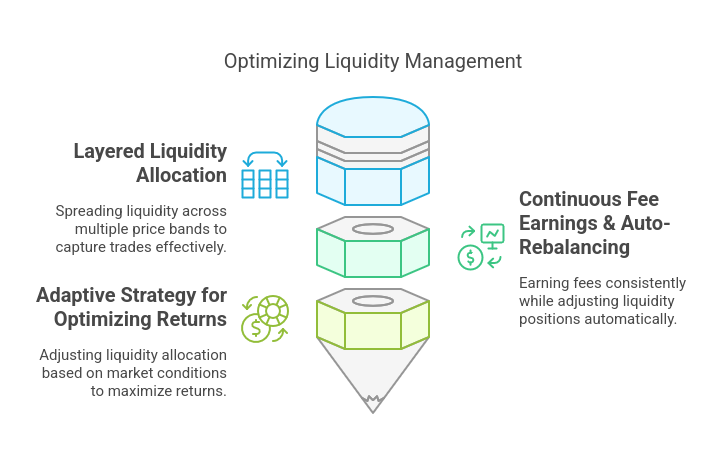

- Layered Liquidity Allocation: When a Steer Smart Pool deploys your funds, it doesn’t put all your capital at one price point. Instead, it spreads liquidity across several layers or bands around the current market price. For example, suppose an asset is trading at $1,000. Steer might place a portion of liquidity in a narrow band very close to $1,000 (e.g. $990–$1,010) to capture the majority of trades. Simultaneously, it could position additional liquidity in slightly wider ranges, say $950–$1,050 and $900–$1,100, using progressively smaller portions of capital. This multi-band setup ensures a deep liquidity well at the center and continuous coverage if the price moves outward. In effect, Steer creates a custom liquidity curve by combining these positions, rather than a flat distribution.

- Continuous Fee Earnings & Auto-Rebalancing: As trading occurs, the narrow bands around the market price earn a lot of fees (thanks to high utilization). If the price starts trending in one direction, the Smart Pool responds by shifting the liquidity layers. For instance, if the price rises from $1,000 to $1,050, Steer will slide the bands upward: the band that was $990–$1,010 might be closed or moved to now straddle $1,050–$1,070, and similarly adjust the other bands higher. Crucially, because there were multiple overlapping ranges, some liquidity was still earning fees even during the move (the wider $950–$1,050 band remained active until the new bands were placed above). The system routinely harvests fees and rebalances positions so that liquidity is always centered around the current price and ready for the next trade. This means no significant portion of capital stays inactive for long – it’s either earning fees or being repositioned to do so imminently.

- Adaptive Strategy for Optimizing Returns: Steer’s algorithm can adjust not just where liquidity sits, but how much to allocate to each band based on market conditions. In times of high volatility, Smart Pools might choose to widen ranges (or allocate a bit more to the outer bands) to avoid excessive impermanent loss, at least until volatility subsides. Conversely, in a stable price range, the strategy might concentrate more funds tightly to maximize fee generation. Steer’s off-chain computations come into play here, analyzing metrics like recent volatility, trading volume, and price momentum to dynamically tweak the liquidity distribution. The goal is to always strike an optimal balance between earning the most fees and managing risk. Over time, as fees accrue, they are either reinvested (increasing the liquidity in each range) or can be claimed by LPs, but importantly, the relative distribution is continuously refined for efficiency.

This dynamic allocation and rebalancing approach is what enables Steer to maintain liquidity efficiency that individual LPs would find hard to achieve on their own. By ensuring that there’s always liquidity positioned where the market needs it, Steer Smart Pools capture trading fees that others miss. LP capital isn’t sitting idle outside of the action; it’s constantly working, either in a position earning yield or being shifted to a better position. The result is optimized returns: fees are maximized and downtime minimized, all while the complexity of managing many moving parts is abstracted away by Steer’s infrastructure.

It’s worth noting that this multi-position strategy can also mitigate impermanent loss (IL) to some degree. Since not all the liquidity is in the tightest range, if a big price swing happens, only the nearest band’s liquidity might be converted heavily into one asset, while wider bands still hold a mix and continue earning fees on the new price level. And as the strategy rebalances, it effectively takes profit from the movement by redistributing liquidity. Over long durations, the combination of continuous fee earnings and intelligent repositioning can offset IL better than a single static position would – another reason active management pays off.

Conclusion: Steer Transforms Liquidity Management

The emergence of CLAMMs has undoubtedly revolutionized DeFi by unleashing far greater capital efficiency. Yet, tapping the full potential of concentrated liquidity requires active management – a role increasingly filled by advanced automated protocols like Steer. Steer Smart Pools take the concept of dynamic liquidity management to its pinnacle, delivering an unmatched set of capabilities: multi-range liquidity deployment, adaptive rebalancing guided by real-time data, broad multi-chain access, and an open platform for innovation. By doing so, Steer is transforming liquidity provision from a manual, maintenance-intensive task into a seamless, optimized experience.

For LPs, this means you can earn superior fee income without babysitting your positions 24/7 – deposit into a Smart Pool and let Steer’s algorithms handle the rest, keeping your liquidity active and profitable. For DeFi investors and protocols, Steer ensures deeper and more reliable liquidity for your favorite tokens, which translates to better market health (tighter spreads, lower slippage) and less reliance on unsustainable liquidity mining incentives. For developers and strategists, Steer provides a powerful sandbox to build and deploy bespoke liquidity strategies, accelerating innovation in market-making logic by abstracting away the heavy lifting of execution and distribution.

In a landscape where concentrated liquidity is becoming the norm, Steer Smart Pools stands out as the premier DLMM solution – effectively the smart autopilot for liquidity providers. They harness the raw power of CLAMMs and add brains on top. As a result, liquidity can be managed at scale with efficiency and finesse never before possible in DeFi. Steer has opened the door to a future where providing liquidity is not only more lucrative but also more user-friendly and strategic. For anyone looking to navigate this new era of liquidity management – whether you’re an LP chasing yield, a DeFi project striving for better markets, or a developer reimagining financial Lego – Steer Smart Pools offer a compelling, transformative toolkit to achieve your goals. The days of set-and-forget liquidity are over; the age of smart liquidity has begun.