AI LP Overview

In our last post, we introduced the concept of predictive rebalancing using Allora Network’s AI-driven price feeds to enhance liquidity provision on Steer Protocol. The response from our community was overwhelmingly positive—many of you asked for deeper insight into how these predictions actually work in practice and how they stack up against our traditional, spot-based strategies over time.

Over the past few weeks, we set out to gather hard data to validate these strategies. Specifically, we conducted a comprehensive testing period from January 10 to January 28, comparing our traditional “Classic Rebalance” strategy with the new “Allora Strategy.” Both strategies were deployed under similar market conditions, using BTC- and ETH-focused Uniswap v3 pools. Our primary goal was to determine whether predictive insights truly lead to better outcomes for liquidity providers (LPs)—both in terms of performance and risk management.

In addition, the test environment allowed us to explore real-time adjustments within Uniswap v3’s narrow liquidity bands. As many of you know, concentrated liquidity can boost capital efficiency but also exposes LPs to heightened impermanent loss (IL) if the market moves quickly and liquidity remains out of range. Our hypothesis was that Allora’s AI-powered price feeds would drastically reduce the time spent out of range by preempting significant price shifts—ensuring LP tokens stay active in the fee-generating zone more often.

Finally, we’re pleased to announce that, in tandem with these results, Allora Network is now officially a Steer Data Integration Partner. This not only gives our strategies a formal seal of approval but also means that any builder or developer using Steer can seamlessly integrate Allora’s predictive data into their own DeFi applications.

Below, we’ll walk you through the findings, from the raw performance numbers to the detailed breakdown of how each strategy behaved under different market conditions—and why this signals a new era of proactive liquidity management.

Performance at a Glance

Performance Comparison

From January 10 to January 28, both the Allora-Integrated strategy (“Allora Strategy”) and Classic Rebalance strategy were monitored daily. As seen in the Performance Comparison chart:

- Allora Strategy (Purple): Averaged higher returns throughout most of the testing period, with occasional dips but consistently recovering more strongly.

- Classic Rebalance (Green): Tended to lag behind Allora’s performance line, with slightly more pronounced drawdowns during market volatility spikes.

Key Statistics

A high-level snapshot of how each strategy performed over the testing window:

Notably, Allora’s average performance ended in positive territory (+0.75%), while the Classic strategy’s average dipped just below zero (-0.08%). Moreover, the Allora approach achieved a significantly higher peak performance (4.77% vs. 1.86%) and also exhibited a slightly less severe drawdown on its worst day.

LP Token Price Behavior

One of the most tangible indicators for liquidity providers is the value of their LP tokens over time. In the LP Token Price chart:

- •Allora LP (Orange): Showed a steady upward trend from mid-January onward, reaching its apex around January 25 before a brief pullback. Even after the market dip, it remained at a higher price band compared to the Classic LP.

- •Classic LP (Pink): Displayed similar movements but generally stayed at a lower price point, and its largest drop around January 27 was more pronounced, leaving it with a lower recovery level compared to Allora by the end of the period.

This confirms our hypothesis that predictive, proactive rebalancing helps LPs maintain in-range liquidity more effectively, thus preserving and growing the intrinsic value of their LP tokens.

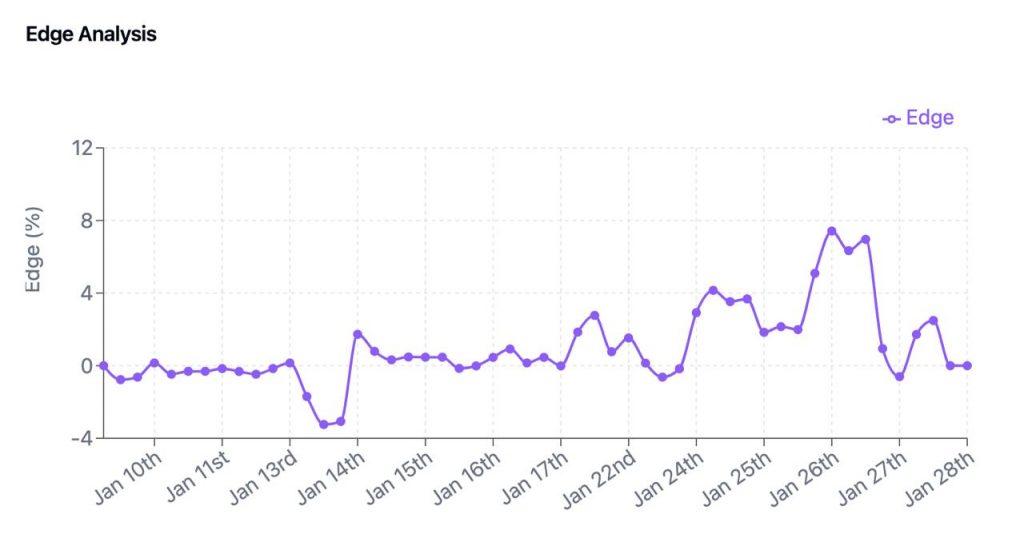

The “Edge” Factor

Another important metric we tracked was the “Edge” (%)—a measure of the strategy’s advantage in terms of positioning and market alignment. The Edge Analysis chart often hovered between 0–5% for much of January, but we observed spikes to nearly 10% or more during times of rapid price movement. These surges underscore how preemptive adjustments (guided by Allora’s forecasts) can yield substantial, short-term advantages over reactive strategies.

How Allora’s Predictive Feeds Drove Outperformance

From our original deep dive, we anticipated that Allora’s AI-driven price forecasts would:

- Preempt Rebalancing Lag: By shifting liquidity ranges before significant price moves, we reduced both impermanent loss (IL) and losses due to delayed rebalancing (LVR).

- Maintain Balanced Asset Ratios: Proactive range adjustments kept asset allocations closer to their ideal composition, diminishing IL and preserving fee-earning power.

- Improve Capital Efficiency: By continuously staying “in range,” LP tokens enjoyed higher fee generation without frequent out-of-range downtime.

The empirical results align perfectly with these expectations. When volatility struck on or around January 14 and again on January 26–27, the Allora-Integrated strategy recovered and repositioned more quickly, fending off deeper drawdowns.

Welcoming Allora as a Data Integration Partner

We’re thrilled to announce that, beyond powering our liquidity strategies, Allora Network has joined Steer’s roster of Data Integration Partners. Alongside well-known providers like TheGraph, n.xyz, and Transpose, Allora brings its cutting-edge AI/ML predictive feeds to the Steer marketplace. Builders, developers, and end-users can now harness these forecasts directly within their own DeFi apps, unlocking new frontiers in liquidity management.

This partnership cements Allora’s role as a core data provider within the Steer ecosystem, enabling a wide range of innovative strategies that go well beyond just Uniswap v3.

Conclusion

This testing period reaffirms our core thesis: proactive, AI-driven rebalancing yields measurably better outcomes for liquidity providers in Uniswap v3. By anticipating price movements rather than merely reacting to them, our Allora-Integrated strategies stayed in range more often, captured more fees, and navigated volatility with fewer losses. The addition of Allora as a Data Integration Partner widens the range of possible use cases—both within Steer Protocol and across the DeFi ecosystem at large.

As we continue to push the boundaries of on-chain liquidity management, we remain committed to harnessing the best in AI, data analytics, and risk modeling. Thank you for joining us on this journey, and stay tuned for more innovations that will further empower LPs to thrive in today’s dynamic DeFi markets.