Steer Protocol provides the infrastructure and tools to build thriving, sustainable DeFi projects. We understand the multifaceted challenges involved and offer an interconnected suite of products to address them head-on, simplifying complexity and fostering growth.

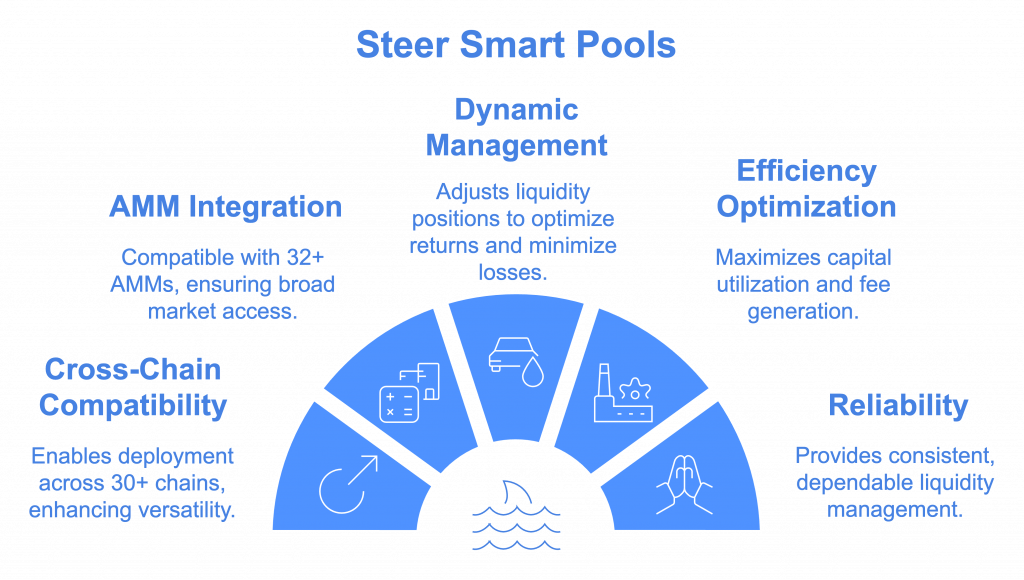

The Foundation: Steer Smart Pools – Automated Liquidity Management:

Steer Smart Pools is the industry-leading automated liquidity manager (ALM) and the foundational component of the Steer ecosystem. Deployable across 30+ chains and compatible with 32+ AMMs including Uniswap V3, SushiSwap, Camelot, Smart Pools offer sophisticated, active management for liquidity positions. This robust ALM engine powers several other Steer products, ensuring efficient capital utilization and optimized returns. As mentioned in our earlier conversation, many protocols struggle with the intricacies of liquidity management, leading to inefficiencies and missed opportunities. Smart Pools tackles this challenge head-on, abstracting away the complexities and maximizing returns. Unlike static liquidity positions, Smart Pools dynamically adjust to changing market conditions, minimizing impermanent loss and maximizing fee generation. It’s the reliable, always-on liquidity manager that protocols can depend on.

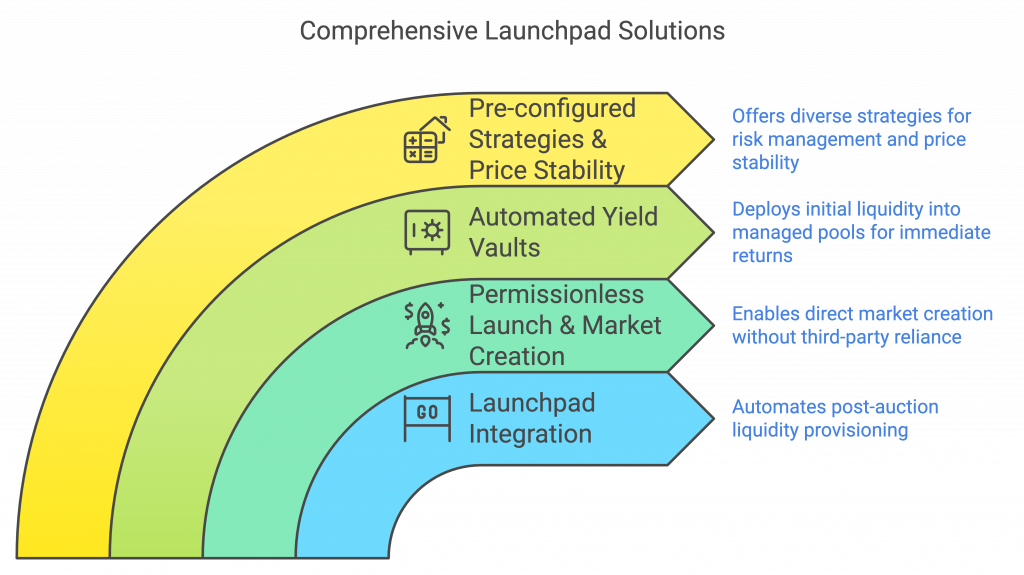

Streamlined Token Launches with Steer Smart Launch

Steer Smart Launch simplifies token launches and establishes robust initial liquidity through the power of Smart Pools:

-

Launchpad Integration: For projects utilizing launchpads, Smart Launch offers seamless integrations to automate post-auction liquidity provisioning. This ensures a smooth transition to a vibrant and active market upon sale completion.

-

Permissionless Launch & Market Creation: Launch directly from the Steer Protocol app with an intuitive market creation interface. Design your ideal launch parameters without relying on third-party platforms.

-

Automated Yield Vaults: Initial liquidity is automatically deployed into actively managed Smart Pools, creating yield-generating vaults from the moment of launch. This provides immediate market depth and attractive returns for early participants.

-

Pre-configured Strategies & Price Stability: Choose from a comprehensive library of pre-configured launch strategies tailored to various token types and risk profiles. These strategies, powered by Smart Pools, include innovative mechanisms for managing volatility and promoting early price stability, minimizing risk and attracting early adoption. Steer boasts one of the largest LP strategy libraries in the industry, providing unparalleled flexibility and customization options.

Sustainable Liquidity and Community Engagement

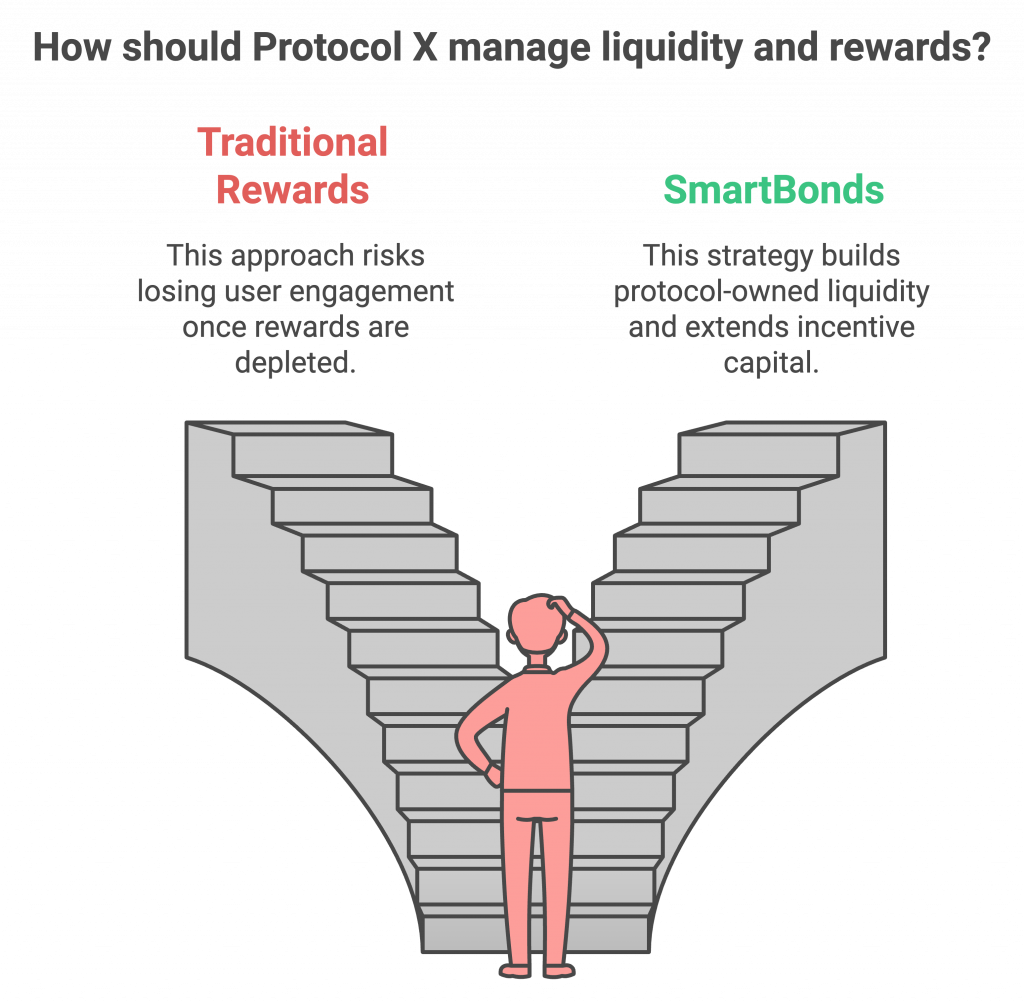

Protocols and Chains are always looking to get a better return on incentives while engaging better with their users. One of the bigger issues today is that most incentives are a rent based system with most the liquidity leaving the system once the campaign is over, creating a vicious cycle of never ending inflationary campaigns. Out with the old and in with the new, Steer provides the tools to build lasting liquidity and a thriving community:

-

Steer Smart Rewards: Design and deploy flexible incentive programs leveraging on-chain and off-chain data. Reward community participation, liquidity provision, and other key actions with targeted precision. Bring your own or leverage our existing infrastructure with point and click ease. This isn’t just another quest platform, this is a native yield layer for any protocol or chain.

-

Steer SmartBonds: Acquire and own liquidity by bonding Smart Pool LP tokens. This allows chains, foundations, and projects to accumulate yield-bearing assets while benefiting from the derisked, actively managed positions offered by Smart Pools. This approach shifts the paradigm from renting liquidity to owning it, fostering long-term stability and value accrual.

-

The old way: Protocol X gives away all $10,000 as rewards. Users come for the rewards, then leave when they’re gone. Your liquidity dries up.

-

SmartBonds: Protocol X offer $10,000 worth of TOKEN for sale as bonds. Users provide LP tokens (representing an actively managed position in Protocol X trading pair) to buy these bonds. This gives the project protocol owned liquidity in the form of yield bearing Steer LP tokens. The users, in turn, receive a premium on the value of their LP. You only spend TOKEN equivalent to the value of liquidity you are accruing. If users only provide $5,000 worth of LP tokens to buy bonds, you keep the remaining $5,000 worth of TOKEN, allowing you extend the length of the capital allocated to incentives while also adding $5,000 of protocol owned liquidity to protocol treastury.

-

Expanding Spot Markets

Projects have a hard time accumulating the capital for launching spot markets. Many must fundraise or incentivize for each individual additional instrument, be it lending, options, or bridge liquidity. To ease this pain, we’ve pioneered a suite of additional products which allow teams to creation of comprehensive token markets on day one:

-

Steer Options Vaults: Leveraging Smart Pools’ universal application layer, Options Vaults seamlessly integrate to allow options trading on top of existing liquidity. This provides a crucial bridge between projects current spot markets and more sophisticated derivatives, opening up new possibilities for traders and protocols alike.

-

Steer Liquidity Hooks: The goal, a single liquidity funnel to bootstrap derivatives, lending, and bridge liquidity for a token. Built for Uniswap V4 and Algebra Integral, Steer’s Liquidity Hooks maximize capital efficiency and protocol interoperability by routing a portion of Smart Pool liquidity into lending markets and other DeFi protocols. This creates a composable ecosystem where assets can flow dynamically into different opportunities.

AI-Powered DeFi – Unleashing the Potential of Agents

Steer recognizes the transformative potential of AI agents in DeFi and has built a platform primed for their seamless integration. Steer empowers agents to interact with on-chain markets and protocols in unprecedented ways:

-

Rich Data Access: The Steer Data Marketplace becomes the agent’s central hub for information, providing access to over 100+ on-chain and off-chain data sources through a simple connector system. This wealth of data empowers agents to make informed decisions, analyze market trends, and execute sophisticated strategies.

-

Native On-Chain Yield: Agents can directly deposit assets into Steer Smart Pools and related products, gaining exposure to native on-chain yield opportunities. This allows agents to manage and grow their portfolios autonomously, maximizing returns and optimizing for specific risk profiles.

-

Agent-Managed Liquidity: Steer allows AI agents to become managers of Smart Pools, controlling the liquidity ranges and actively participating in market making. This opens up exciting possibilities for automated liquidity provisioning and dynamic strategy execution.

-

Strategy Library Access: Agents can leverage Steer’s extensive strategy library, accessing and configuring over 15+ pre-built LP strategies. This provides a flexible framework for agents to customize and deploy sophisticated trading and yield farming strategies.

-

Programmatic Market Creation: Streamline token launches and bootstrap liquidity with a single action. Agents can programmatically create new tokens, establish markets on supported DEXs, and deploy initial liquidity into Smart Pools, automating the entire process from start to finish.

-

AI-Native Incentive Campaigns: Design and deploy targeted incentive campaigns on top of any on-chain vault managed by Steer. Our tools are AI-native friendly, with built-in descriptors for seamless integration with popular agent platforms like Langchain and others.

The Steer Advantage:

-

Connected Ecosystem: An integrated suite of products designed to work synergistically.

-

Simplified Complexity: Democratizing access to sophisticated DeFi tools and strategies.

-

Active Liquidity Management: Smart Pools provide a foundation of optimized liquidity management.

-

Ownership and Control: Foster long-term value accrual through owned liquidity and decentralized infrastructure.

-

Future-Proofing with AI: Seamless AI agent integration for automation and optimization.

-

Experienced Team: Developed by a team with deep expertise in blockchain and DeFi.

Partner with Steer Protocol to build a thriving and sustainable DeFi ecosystem. Contact us to discuss how Steer can empower your protocol or chain.